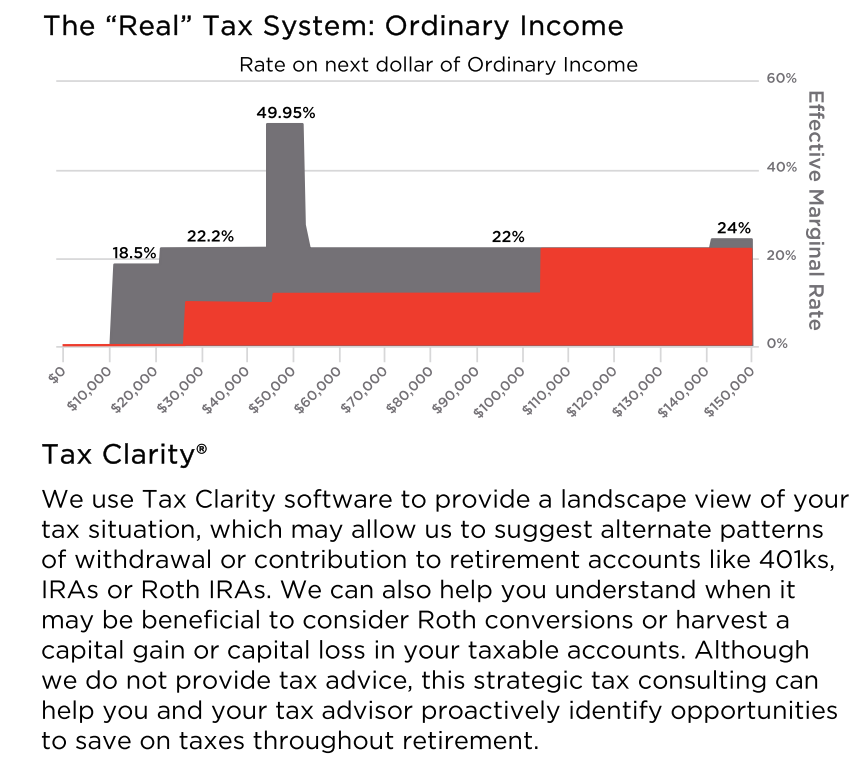

One of the main villains of retirement is taxes. Marginal tax rates cause retirement income to be taxed at high rates as high as 49.5% while the tax brackets remain as low as 10, 12, or 22, 25, 27%. As most retirement assets are as yet untaxed, our tax software can reveal the high cost of taxes in retirement and allow us to minimize taxes to the lowest possible marginal tax bracket rates.

The impact of marginal taxes is a retirement deal killer.